Ach Processing Things To Know Before You Buy

Table of ContentsHow Ach Processing can Save You Time, Stress, and Money.All About Ach ProcessingAch Processing Fundamentals ExplainedThe Buzz on Ach Processing

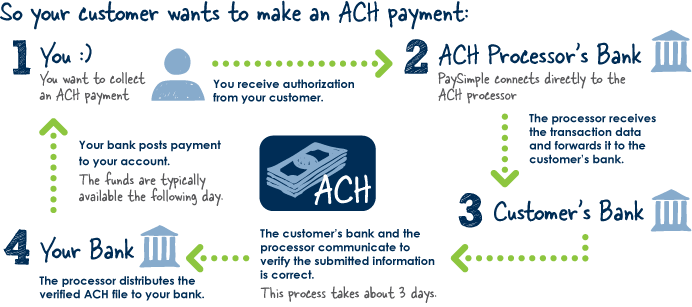

Much more just recently nevertheless, banks have actually concerned enable exact same day ACH settlements or next-day ACH transfers that take only one to two company days. So as lengthy as the digital repayments demand is submitted before the cutoff for the day, it's feasible for the money to be received within 1 day - ach processing.No issue what kind of ACH repayments are included, a transfer is a process of 7 actions, which starts with the money in one account and finishes with the cash showing up in another account. ACH settlements start when the begetter (payer)begins the procedure by requesting the purchase. The originator can be a customer, organization, or a government firm.

When a purchase is launched, an entrance is submitted by the financial institution or repayment processor dealing with the first stage of the ACH settlements process. The bank or settlement cpu is understood as the Originating Depository Financial Institution (ODFI). Financial institutions commonly send out ACH entrances in batches, commonly 3 times a day throughout routine company hrs.

Federal Reserve financial institutions and the EPN are national ACH operators. Once received, an ACH operator types the batch of entries into down payments and also repayments, and settlements are after that sorted right into ACH debt as well as debit settlements.

An Unbiased View of Ach Processing

When getting ACH payments, the getting economic establishment either credit ratings or debits the getting bank account, depending on the nature of the purchase. While the overall cost connected with accepting ACH payments differs, ACH fees are often much cheaper than the costs connected with accepting card settlements. Among the largest cost-influencers of approving ACH settlements is the volume of purchases your organization plans to process.

Whether you're an acquirer, settlements cpu or merchant, it's essential to be able to acquire total real-time exposure into your settlements community. Improperly executing systems boost disappointment throughout the entire settlements chain. Bringing real-time exposure and settlement tracking to your entire setting, Transact uncovers unparalleled understandings into ACH purchases and also repayments fads to assist you improve the payments experience, turn information into intelligence, and guarantee the settlements that keep you in company.

The Ach Processing Statements

Possibilities are you have actually already used ACH settlements, yet are not familiar with the lingo. ach processing. Some of the instances of ACH transactions consist of: Online expense payments via your bank account, Moving money from one bank account to an additional, Paying suppliers or receiving cash from consumers by means of straight down payment, Straight down payment pay-roll to a worker's monitoring account made use of by firms, Allow's discover ACH payment processing much more in information.

The ACH network of financial institutions (financial institutions as well as credit scores unions) facilitates purchases in the USA as well as is managed by National Automated Clearing Residence Association (NACHA). According to NACHA, ACH settlements daily went beyond 100 million in February 2019. The most recent numbers from NACHA disclosed a 7. 1% increase in ACH deal quantity for the first quarter of 2020, with B2B repayments uploading an 11.

You transfer cash to a Silicon Valley Bank account from your Financial institution of America account. And a person does an inverse purchase as well. Both the financial institutions need to credit score and also debit each other's accounts. An instantaneous credit/debit process for each transaction might seem much faster, but has a great deal of underlying downsides.

ACH is one such central cleaning system for financial institutions in the US. ach processing. Cord transfers are interbank electronic repayments. While cord transfers appear to be similar to ACH transfers, here are some vital distinctions between them: Can take a couple of organization days, Immediate, Free for a receiver, nominal fees ($1) for a sender, Both the sender and also receiver are charged fees.

More About Ach Processing

Can be view it now contested if problems are satisfied, As soon as launched, can not be canceled/disputed, No human treatment, Usually involves bank staff members, Both send and also request settlements. For payment demands, you need to post the ACH data to your financial institution. Only send out repayments, Refined in batches, Refined real-time, A cable transfer is optimal for you when time is essential, while ACH handling is a much better option for non-mission-critical as well as persisting repayments. Now in Bonuses any kind of transfer, 2 people are involved.

Your client licenses you to debit their checking account on his behalf for reoccuring deals. Allow's say Jekyll has to pay a sum of $100 to Hyde (think they're two different people) and chooses to make an electronic More Info transfer. Right here is a detailed breakdown of how a bank transfer via ACH works.

Comments on “Ach Processing Things To Know Before You Buy”